Moody's sifts through UK's asset management reform proposals

Chris Hamblin, Editor, London, 30 November 2016

"Active managers are not currently structured to operate at significantly lower fee rates and the Financial Conduct Authority’s proposed fee structure will require significant expense reduction." So says Moody's, the credit rating agency, which is expecting a wave of mergers as a result.

Two weeks ago the UK's Financial Conduct Authority published its reflections so far on the asset management market study it initiated a year ago. In response to the study’s findings of weak price competition in a number of areas that hurt investor returns, the FCA proposed to improve competition and make funds divulge more information to it and to investors. Moody's, however, believes that this will drive up 'execution risk' and compliance and operational costs while fees come down, squeezing active asset managers’ profit margins.

Active managers, according to the credit rating agency in its latest communiqué, are not currently structured to operate at significantly lower fee rates and the FCA’s proposed fee structure will require significant expense reduction. Cost management and economies of scale will likely become a priority and translate into market consolidation.

Consolidation in the offing?

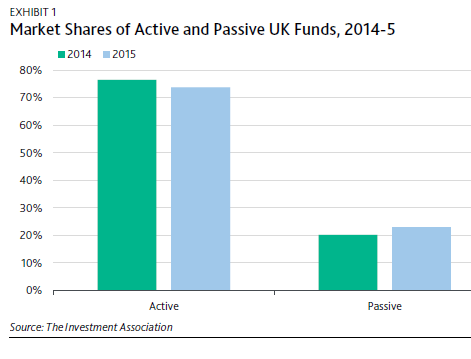

As the competition with passive investment intensifies (see diagram), Moody's believe that asset managers will also focus on making or saving money for investors and will have to adapt their business models to a more competitive environment. Those moving first will be most resilient to these negative forces. Bigger firms that offer both active and passive management such as BlackRock (A1 stable) or that have diversified fund offerings and captive insurance client bases such as LGIM, the asset management arm of Legal & General Group (A3 negative), are better positioned than their smaller or less diversified peers to respond to the building regulatory and market pressures.

Declining confidence in actively managed funds

The FCA findings show that actively managed fund charges have stayed broadly flat for the past 10 years, suggesting weak price competition among asset managers, while charges for passive funds have fallen. The FCA noted that as active funds grow, prices do not fall, suggesting that only asset managers capture economies of scale. The relationship between price and performance also appears low. According to the FCA, 42% of active funds have a low tracking error, indicating that they mimic the performance of their benchmarks, and after costs, very few active funds outperform their benchmarks, limiting their value to investors. These findings will probably exacerbate the loss of confidence from which the active-management sector is already suffering.

To offset the opacity of cost and performance information, which renders comparison between products difficult, the FCA proposed to introduce a single fee for investors, inclusive of all costs. It suggested reforms to hold asset managers accountable for how they manage investors' wealth, requiring asset managers to state fund objectives, regularly report on fund performance versus objectives, and provide increased transparency, standardisation and communication on costs and charges clearly.

Additionally, the FCA expressed concerns about the ability of fund governance bodies, advisors and consultants to help investors select better-performing managers or funds, and is thinking of extending the notion of consultants and asset managers’ fiduciary management to incorporate clients’ best interests. Asset managers will, if its plans go ahead, have to show it that they are providing various investors with the right investment product (risk/return) at the right price. The FCA will gather market feedback on the proposals until 20 February 2017. The FCA expects to publish its final report and remedies in 2017.

* The analysts who compiled Moody's response to the FCA's initiative are available at tiziano.oliva@moodys.com and marina.cremonese@moodys.com