Abu Dhabi Global Market adds to AML rules

Chris Hamblin, Editor, London, 17 April 2019

In accordance with Part 2 Financial Services and Markets Regulations 2015, the Financial Services Regulatory Authority of the Abu Dhabi Global Market has embarked on a modest tidying-up exercise by issuing a few new rules and re-wording some old ones.

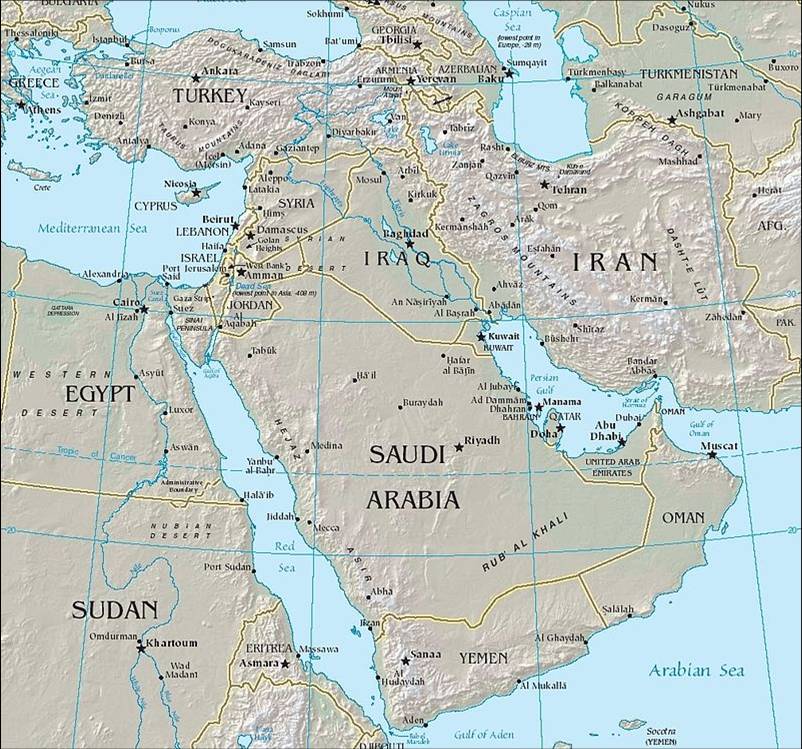

The FSRA published the amendments to its rules on 15 April. Under section 15A of the regulations, the regulator has jurisdiction for the regulation of AML in the market. Relevant UAE criminal laws include Federal Law No 3 of 1987 (the Penal Code of the United Arab Emirates). Nobody should rely on the AML rulebook in an attempt to interpret the criminal laws of the UAE.

Follow the Big Boys

The regulatory rules now mention the Wolfsberg Group of thirteen huge private banks. This group has published guidelines to govern so-called "money laundering risks" (to which it has given the cumbersome title of the Wolfsberg Statement Guidance on a Risk-Based Approach for Managing Money Laundering Risks of March 2006) and in preventing terrorist financing (Wolfsberg Statement on the Suppression of the Financing of Terrorism of January 2002). The regulator says that banks operating in the ADGM should be familiar with relevant guidelines published by the Wolfsberg Group in conjunction with the FATF's famous 40 recommendations and in complying with its own rules. In the event that any of the Wolfsberg Group's guidelines conflict with a rule in the AML rulebook, the rule takes precedence.

The Basel Committee on Banking Supervision once published a set of guidelines for banks (Sound Management of Risks related to Money Laundering and Financing of Terrorism, January 2014). The regulator wants banks in the ADGM to read this document when they attempt to comply with its rules, although this is not a binding requirement.

What is a customer?

The point at which a person becomes a customer will vary from business to business but the regulator considers that it would usually occur at or prior to the business relationship being formalised, for example by the signing of a 'client agreement' or the acceptance by the prospective customer of terms of business. The regulator does not consider that a person would be a customer of a 'relevant person' (the ADGM's term for a financial firm and/or someone obliged to produce certain documents) merely because that person receives marketing information from the firm or because the firm refers a person who is not a customer to a third party (including another firm in its own group). The regulator considers that a counterparty would generally be a customer for the purposes of the AML rulebook and would therefore require the firm (or some other firm at least) to be "customer duly diligent" about it. This cannot include a counterparty in a transaction undertaken on a regulated exchange, nor a suppliers of an ancillary business services for consumption by the firm such as cleaning, catering, stationery or IT. A representative office should not have any customers in relation to its operations in the ADGM.

The meaning of words

Some additions to the glossary are interesting, if only as a guide to the way in which jurisdictions are interpreting the dictates of the FATF.

'Senior management', in relation to a relevant person, means every member of the firm's executive management and includes: (i) for an ADGM entity, every member of the relevant person's governing body; (ii) for a branch, the people who control the day-to-day operations of the firm in the ADGM; or (iii) for an auditor, every member of the firm's executive management in the UAE.

A shell bank is a bank that has no physical presence in the country in which it is incorporated or licensed and which is not affiliated with a regulated financial group that is subject to effective consolidated supervision.

'Source of funds' means the origin of a customer's funds which relate to a transaction or service and includes the way in which such funds are connected to the source(s) of a customer's wealth. 'Source of wealth' means the way in which the customer's global wealth or net worth is or was acquired or accumulated.

New rule 8.3.3 obliges every firm to identify the beneficial owner(s) of every customer-firm. It must identify any natural person who owns or controls (directly or indirectly) 25% or more of its shares or voting rights or exercises ultimate control over its management.

8.3.3(3) adds that someone controls a body corporate if he holds, directly or indirectly, the right to appoint or remove a majority of the board of directors or the right to exercise, or actually exercises, significant influence or control over it. This does not apply to bodies corporate that are listed on stock exchanges or owned by any government in the United Arab Emirates, including its Federal Government, or created by an emir's decree.