Regtech will reduce budgets, says GlobalData

Chris Hamblin, Editor, London, 1 March 2018

Wealth managers will spend much of 2018 having to comply with new rules, thereby having to defray further operating costs. Regulatory IT, however, will make the process more cost-efficient, according to a survey by the data analysis firm of GlobalData.

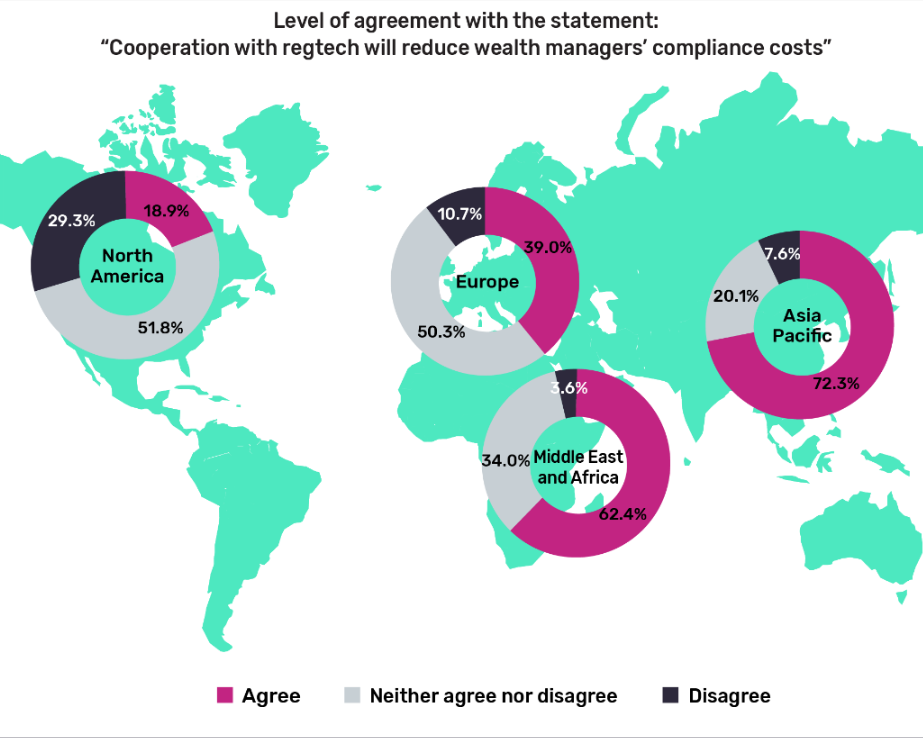

Among the surveyed wealth managers in the Asia Pacific region, 72.3% thought that co-operation with 'regtech' was going to reduce their compliance costs; 7.6% definitely did not think this; and 20.1% were undecided. In the Middle East and Africa, 62.4% said yes; 3.6% said no; and 34% were undecided. The enthusiasm of whites was lower, however. In Europe 39% said yes; 10.7% said no; and 50.3% were undecided. In North America 18.9% said yes; 29.3% said no; and 51.8% were undecided. GlobalData offers no explanation for these wide discrepancies, as seen on the chart above.

In Europe, MiFID II entered into force in January 2018 and the General Data Protection Regulation will come into force on 25 May. The US financial services industry is preparing for the Fiduciary Rule, which is due to come into force next year. All countries that signed the Organisation for Economic Co-operation and Development’s agreement on the automatic exchange of information must now be fully compliant with the Common Reporting Standard and must report on accounts held by their wealthy residents.

Regulation has weighed heavily on wealth managers’ operating costs in the past few years. Wealth of Opportunities II, a joint report by the British Banking Association and the Wealth Management Association, shows that operating costs climbed steadily up to 2015, mainly because of spending on regulatory compliance.

GlobalData’s 2017 Global Wealth Managers Survey found that 75.3% of wealth managers in the world regard national regulatory changes as a great worry.

Silvana Amparbeng, wealth anagement analmyst at GlobalData, commented: “The two associations estimate that technology investments have been beneficial, helping the industry reduce its overall costs by 3% over 2016 compared with 2015. This is especially true for compliance costs; as per our survey data, over half of wealth managers believe that cooperation with regtech will reduce compliance costs. Of course, differences apply across markets. Asia Pacific is the most willing to implement regtech solutions, while North America is less enthusiastic.

“Nonetheless, considering the busy year ahead in terms of regulatory changes, wealth managers would do well to consider partnering with regtech companies. Smaller players with limited resources to dedicate to compliance will find outsourcing these tasks to be particularly cost-efficient.”