SEC awards informant $4 million

Chris Hamblin, Editor, London, 26 September 2016

The US Securities and Exchange Commission's 'Office of the Whistleblower' has awarded more than $4 million to an informant whose original information alerted the agency to a fraud.

The SEC’s whistleblower programme has awarded more than $111 million to 34 telltales since its inception in 2011. The highest award of this year was $22 million, handed over in August. The largest ever, $30 million, was awarded in 2014.

By law, the SEC protects the confidentiality of informants and does not disclose information that might directly or indirectly reveal their identities.

Whistleblowers may be eligible for an award when they voluntarily provide the SEC with unique and useful information that leads to a successful enforcement action. Whistleblower awards can range from 10 percent to 30 percent of the money collected when the monetary sanctions exceed $1 million. All payments are made out of an investor protection fund established by Congress that is financed through monetary sanctions paid to the SEC by securities law violators. No money has been taken or withheld from harmed investors to pay whistleblower awards.

Earlier this month Andrew Ceresney of the SEC's division of enforcement told an audience: "I often speak of the transformative impact that the programme has had on the agency, both in terms of the detection of illegal conduct and in moving our investigations forward quicker and through the use of fewer resources."

He was at pains to point out that the SEC has taken significant steps to ensure that employees at financial firms feel secure in reporting wrongdoing. The SEC, he said, wanted whistleblowers — and their employers — to know that employees are free to come forward without fear of reprisals, which American employees dread far more than British employees.

The SEC has brought its first settled action under the anti-retaliation provisions of the Dodd-Frank Act and four settled actions against companies for breaking Rule 21F-17, which prohibits anyone from taking any action to impede communications with the SEC about possible transgressions against US securities law. The SEC has also actively supported protection for whistleblowers against retaliation through its 'filing' of amicus briefs. It has, notably, submitted six briefs in various courts of appeal and nearly a dozen briefs in district courts, in support of its rule that states that people who make internal reports of possible wrongdoing are protected by its whistleblower rules.

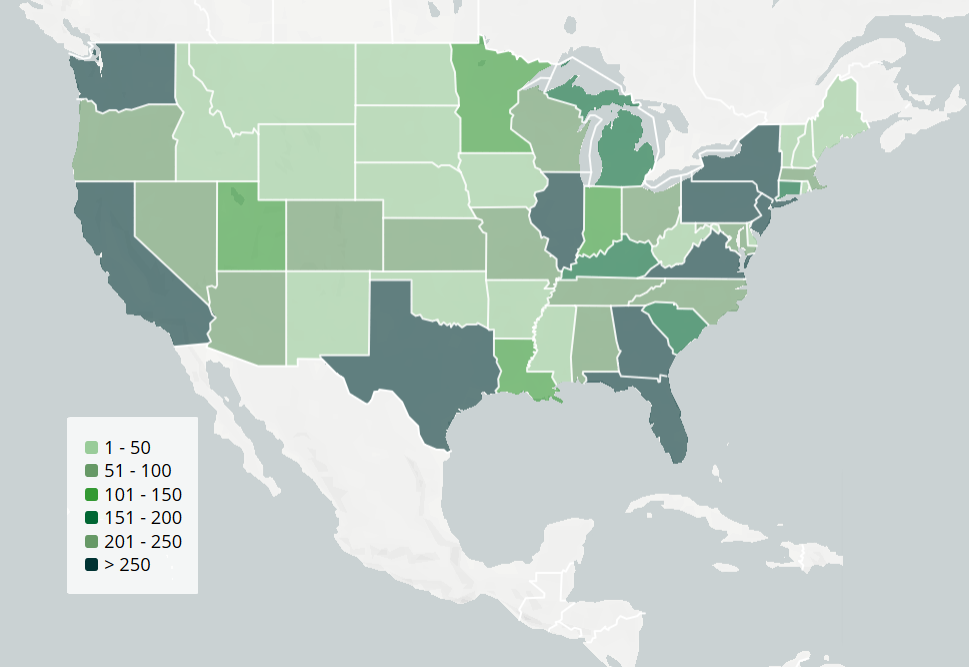

Today, there are 18 dedicated staff attorneys, paralegals and support staff responsible for the initial review and intake of whistleblower tips at the SEC. The tips they have been receiving have grown in number from 3,001 in the fiscal year of 2012 to 4,000 last year. The three main areas of helpful disclosure have been issuer reporting and disclosure cases, 'offering frauds' and Ponzi schemes, and infringements of the Foreign Corrupt Practices Act.

The statute makes awards available only in connection with information submitted to the SEC after 21 July 2010 (see Rule 21F-4(b)(1)).