SEC payments to informants exceed $½ billion to date

Chris Hamblin, Editor, London, 5 September 2016

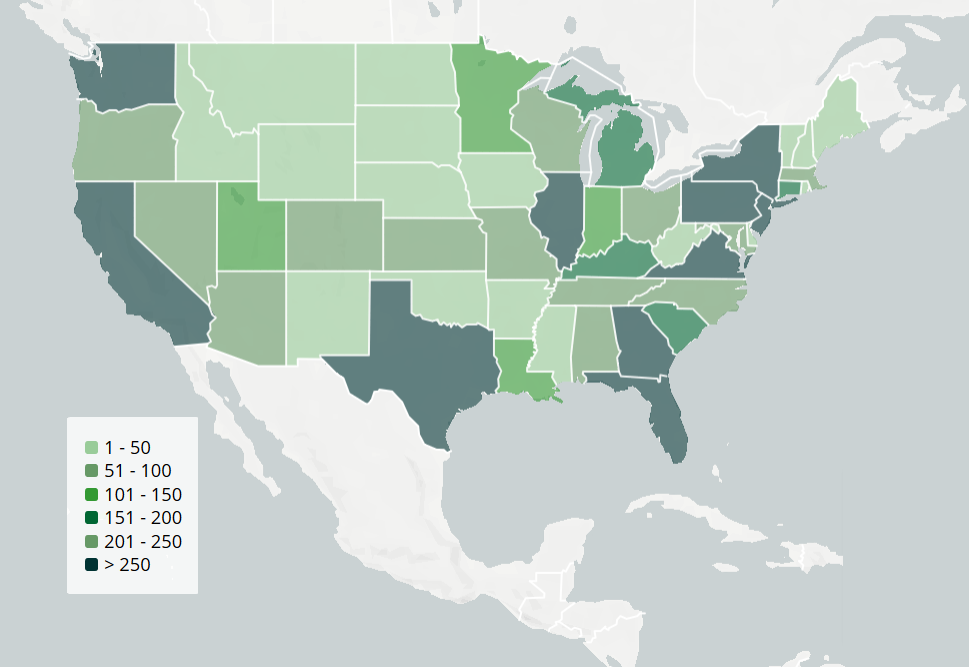

Enforcement efforts triggered off by tips from informants have resulted in more than $500 million in financial gifts to tipsters, according to the regulator. The map shows the total number of tips to date - 10,540 - distributed by state.

The Securities and Exchange Commission’s awards to informers, or 'whistleblowers' as it calls them, have surpassed the $100 million mark with the second-largest award of more than $22 million announced just a few days ago.

The SEC's so-called whistleblower programme was established by Congress to encourage people with specific, timely and credible information about breaches of America's federal securities laws to go to the SEC.

Top 10 awards

Since the programme began, the SEC has awarded $107 million to 33 whistleblowers. The largest of these awards, with their amounts and dates, are as follows.

- 2013: 30th September — $14 million

- 2014: 3rd June — $875,000; 22nd September — $30 million (the largest ever)

- 2015: 22nd April — $1.4 million to $1.6 million; 17th July — $3 million

- 2016: 8th March — $2 million; 13th May — $3.5 million; 17th May — $5 million to $6 million; 9th June — $17 million; 29th August — $22 million

Awards range between 10% and 30% of the money that the authorities collect whenever monetary sanctions exceed $1 million. All payments are made out of an "investor protection fund" established by Congress that is financed through monetary sanctions paid to the SEC by offenders. The SEC has not taken any money from harmed investors, or withheld any from them, to pay informants.

By law, the SEC protects the confidentiality of whistleblowers and does not disclose information that might reveal a tipster’s identity directly or indirectly. Compliance officers, however, are not eligible for awards as the SEC views such disclosures as their ordinary duty.

The life of a tip

First, when one submits a tip, one must use the Form TCR, which contains declarations of eligibility requiring one's signature. One can submit it anonymously but only if one is represented by counsel. Every tipster receives a TCR submission number that he must keep.

When his TCR goes to the SEC, the regulator's lawyers, accountants and analysts review it. If it is a matter the Enforcement Division is working on already, the TCR goes there. Even if the tip does not cause the regulator to open an investigation straight away, the information may be reviewed in the future if more facts come to light and/or the picture becomes clearer. Each tip is evaluated very soon after the SEC receives it by at least two SEC lawyers. The SEC might ask for additional information to evaluate the tip.

The SEC wants specific, timely, and credible information. Sean McKessy, the head of its "Office of the Whistleblower," has written: "A general claim that you think your next-door neighbour is committing securities fraud does not give our investigators much to go on, even if you are right. Our staff will be much better able to pursue an investigation of your tip if they have specific examples, details or transactions to examine. The more information and specifics that you can provide to us to follow up on, the better. People often call us to ask if they should submit something, or submit an update, and we will almost always suggest that you submit it. As I often tell people, you never know what information may be the last piece of the puzzle for an investigation. What may seem small or insignificant to you might be critical to an investigation.

"So, what happens if you submit your tip and it causes an SEC investigation? Our enforcement staff will follow the facts to determine whether to charge an individual, entity or both with securities violations. These investigations can take months or even years to be concluded. Even after the investigation is complete and the commission decides to file a case, the case may be litigated, which may mean significant additional time before the case is resolved. So please understand that it can be a long time before a resolution to the matter is final."

When a penalty (or 'sanction') of more than $1 million is ordered and finalised, the SEC posts a "notice of covered action" on its website. Any tipster can sign up to receive an email each time it posts a new one and might also hear from McKessy's office. If he recognises the case he initiated, he has 90 days to submit a Form WB-APP to apply for an award.

The SEC looks at seven factors when determining whether to increase or decrease the percentage of an award. The four factors that may increase an award are:

- the significance of the information that the informant provides;

- the help that the informant provides;

- any interest from other prosecutors or the police that might be advanced by a higher award; and

- the informant's participation in internal compliance systems - i.e whether he has reported on a company that he has worked for, whether he reported his suspicions/knowledge internally first, and whether he participated in any internal investigation.

Three factors can decrease the percentage of an award. These are:

- culpability;

- an unreasonable reporting delay by the informant; and

- interference with internal compliance and reporting systems.

Even if of all these negative factors apply, however, the informant might still be entitled to an award higher than the 10% minimum.